Today we’d like to introduce you to Jay Joseph.

Hi Jay, I’m so excited to have you on the platform. So before we get into questions about your work life, how can you bring our readers up to speed on your story? How did you get to where you are today?

I was born and raised in Fort Lauderdale, FL, with 3 other siblings. A single mother who raised me and not knowing my biological father encouraged me to seek financial stability to help myself and my family. My mom always taught me to work hard. Throughout high school, I played basketball and worked part-time to help pay bills and stay out of trouble. Right after graduating high school, I moved 4 hours away to Jacksonville, FL, to attend the University of North Florida. I became the 1st in my family to obtain a college degree in accounting. Working in my accounting field, I wasn’t being fulfilled; I still wanted to help others become financially stable, which led me to a successful career as a licensed Financial Advisor at Merrill Lynch for 13 years, serving thousands and managing millions of dollars. Yet again, there was a longing for a greater capacity to serve clients on a deeper financial level, which led to the birthing of Jay’s Money Secrets.

Would it have been a smooth road, and if not, what are some of the biggest challenges you’ve faced along the way?

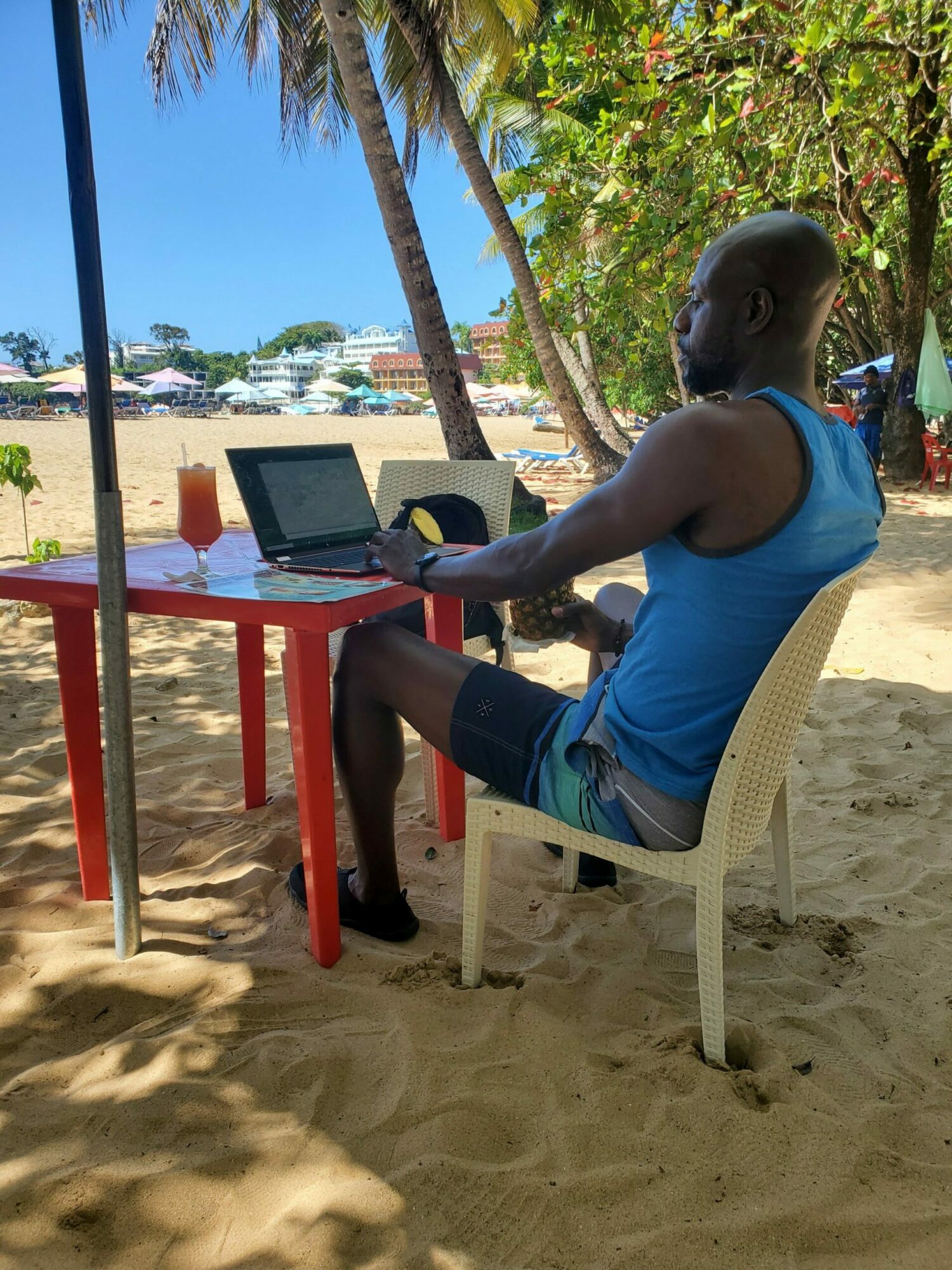

No, to say the least. I needed proper guidance which could of saved me alot of time and money. Growing up, I didn’t have that guidance; I had to learn alot of things on the fly and be comfortable with thinking differenlty than most poeple that were around me. There was times I went without financially. I was embedded by such sayings as “money doesn’t grow on trees.” This led to a mindset of lack and poverty thinking. It’s easy to become a product of your environment. I, as many do, went through the struggles of going from job to job in seek of more money (which was never enough), having a lot of bad debt resulting in bad credit, and consuming more than I was investing because of the money habits that were displayed and the lack of financial literacy in my upbringing. While attending the University of North Florida, I had an eviction and repossession and even spent nights without electricity. At Merrill Lynch, I became dependent on job security solely and got content. Eventually I sought ways to create additional income streams, I had no clue on where to start. I went through a vast array of businesses and investment deals, trying to find my way to create multiple streams of income and build wealth. I had no guidance on becoming wealthy, but I was determined to figure it out to live life on my terms and teach others how to do the same. This gave me the strategy and confidence to step away from being just a financial advisor at Merrill Lynch to a Wealth and Insurance Expert who trades stocks and options that shows people how to build wealth and leave legacies.

Thanks for sharing that. Please tell us more about your business.

Jay’s Money Secrets is a financial literacy brand that helps families, individuals, and business owners build wealth and leave a legacy. As wealth and insurance experts, we are not just a traditional financial/investment planning firm that manages people’s money; we seek to make people financially literate and simplify the process of building wealth to achieve financial independence, which is having money and time freedom. Whether you still need to begin your journey of building wealth, whether you are in your earlier years of building or into your later years, Jay’s Money Secrets will provide you with the education and processes to protect, grow, and transfer your wealth!

Services we Offer:

-Trusts Creation

-Eliminating Bad Debt

-Becoming Your Bank

-Creating a Tax-Free Retirement

-Protecting your Wealth & Income from Major Sickness and Injuries

-Annuities

-Estate Planning

-College Funding

-Retirement Planning

-Business Owners Wealth Strategies

-Pension Maximization and Planning

-401K/403B/TSP/457/TSP/IRA Rollovers

-Traditional & ROTH IRA’s

-Long Term Insurance

-Infinite Banking

-Wealth Strategy Sessions

-Stock Investing & Option Trading education

-Financial Literacy Education Services/Seminars

What changes do you expect to see in your work and the industry over the next five to ten years?

The financial planning industry has typically been slow to adapt to change, mainly becuase majority of advisors being older and the many compliance laws in place. It’s a traditional model that thrives on managing peoples money along with financial planning but many advisor don’t focus on making people wealthy to live on thier owne terms before an older retirement age. With the intorudctions of AI, alot of financial planning is more streamlined helping adviosrs connect to thier targeted audiences. As young advisors with a desire to be in control of thier time, such as myself, enter into this field, we more unorthodox ways of helping people build wealth and not just giving them planning tips and managing their money, the possibilities are endless. I see many older advisors retiring and being replaced with younger advisors, leading to more virtual meetings with your advisors; more creativity as the excellent wealth transfer begins, other alternative investments and more creative businesses will be created, earning more money. This is where Wealth advisors like myself can be a guide and thrive!

Contact Info:

- Website: www.jaysmoneysecrets.com

- Instagram: Jaysmoneysecrets

- Facebook: Jays Money Secrets

- Youtube: Jaysmoneysecrts

Image Credits

Blue Franswa