Today we’d like to introduce you to Ken Remsen.

Hi Ken, we’d love for you to start by introducing yourself.

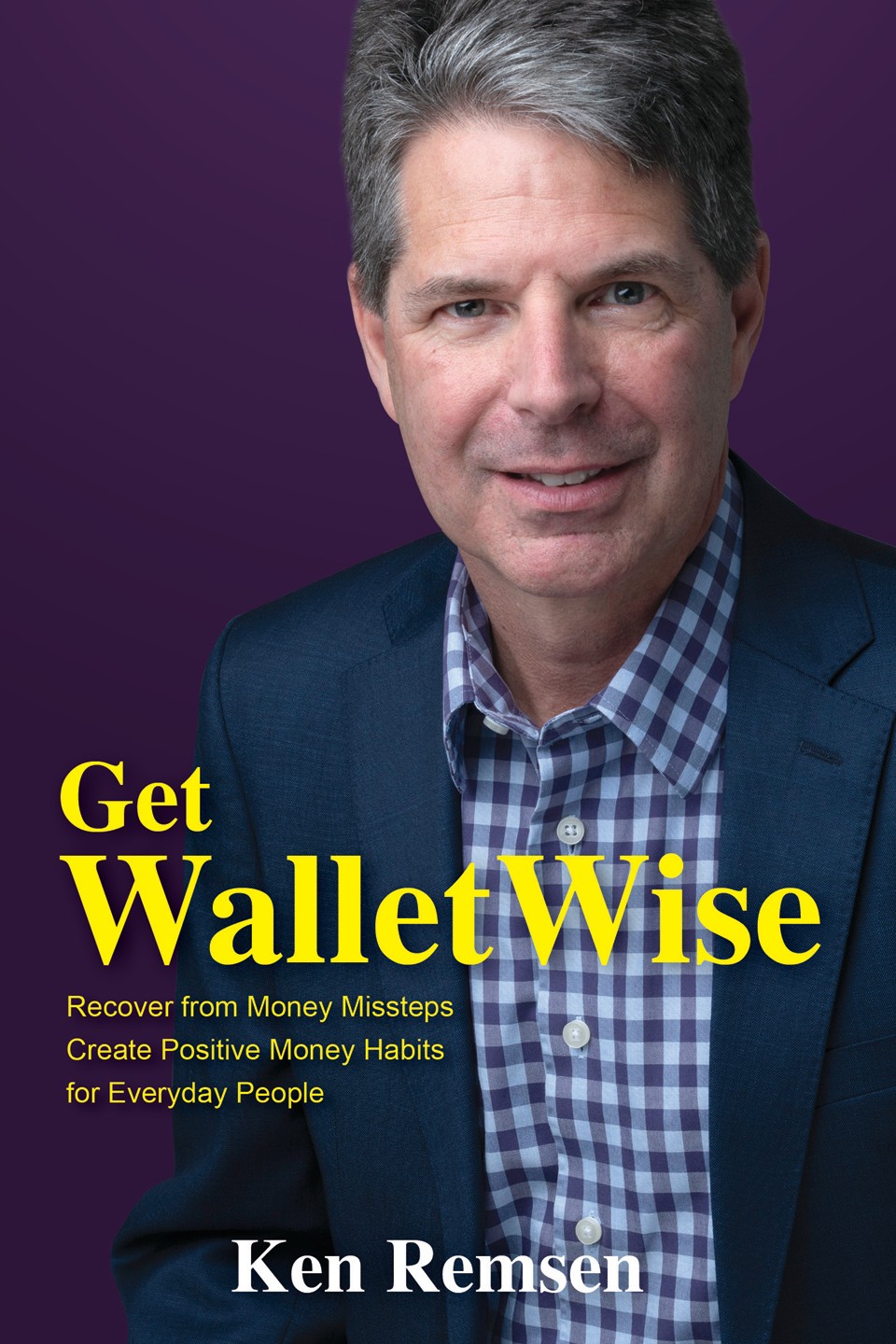

While working as a public school math teacher, I was asked to manage an estate. After the work was over, I asked, “how do regular families handle estate planning without a trusted advisor? ” I joined two organizations to learn more. The American Association of Daily Money Managers and the Association for Financial Counseling & Planning Education. These two organizations helped me embark on a new financial education journey. I opened the financial coaching business WalletWise, LLC. I retired from teaching, ceased coaching, and began working for Fidelity Investments as a Stock Plan Consultant. Through their assistance, I was able to possess all the required FINRA licenses to be a financial planner and earn my CFP® designation. I decided that financial counseling and coaching were my passion and decided to leave Fidelity Investments to work as a Department of Defense Personal Financial Counselor. I wrote the personal finance literacy book, Get WalletWise, which encourages consumers to recover from money missteps and create positive money habits to improve their financial literacy. I currently help clients with financial counseling, provide corporate training and provide keynote speaking services.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

For my business it has been a smooth road. I suggest that aspiring business owners have one year of living expenses saved so they can concentrate in getting their business off the ground. I have counseled former business owners that have many thousands of dollars of debt. I don’t recommend that.

Great, so let’s talk business. Can you tell our readers more about what you do and what you think sets you apart from others?

WalletWise LLC owner Ken Remsen, CFP®, financial coach and counselor, shows customers how to create a sustainable spending plan, establish a debt reduction plan, monitor insurance coverage and estimate the success of retirement finances. The website https://www.walletwise.org/ is a financial literacy platform that includes free resources for budgeting, credit card management, and more.

Ken wrote the personal finance literacy book, Get Wallet Wise, which encourages consumers to recover from money missteps and create positive money habits to improve their financial literacy.

Ken worked as a Department of Defense contractor providing one-on-one financial counseling to Air and Army Florida National Guard service members. Conducted training classes and group meetings for up to 400 service members. Topics included credit management, debt reduction, car-buying coaching, real estate purchase coaching, investment education and retirement planning.

Let’s talk about our city – what do you love? What do you not love?

One of the best things I like about our city is the friendly atmosphere. There are a lot of people interested in helping the community. I have attended many community service events over the years, and it is one part of Jacksonville culture to be proud of. There are a lot of helpers here.

The thing I like the least is the traffic.

Contact Info:

- Website: https://www.walletwise.org/

- Facebook: https://www.facebook.com/walletwise.org/

- LinkedIn: https://www.linkedin.com/in/ken-remsen/

![]()